The Invisible Bank

By 2030, technology will have made banks and banking invisible to customers, hidden by a personal assistant (the granddaughter of Cortana or the great-nephew of Siri) that fulfils daily personal and financial obligations, informed by data gathered from a fully connected way of life.

This is what KPMG claims. To illustrate its vision for “The Bank of the Future”, KPMG has imagined EVA (Enlightened Virtual Assistant) that uses advanced data analytics, voice authentication, artificial intelligence, connected devices, application programming interface (API), and cloud technology to serve customers.

In an example of a day with EVA, the assistant – with an almost omniscient presence – moves savings to get a better interest rate and suggests a yoga class to counteract the impact of a rise in junk food purchases and downturn in health (apparent from the user’s wearable device data). After soliciting the user’s agreement, EVA books and pays for the class.

“Finance will be the most disrupted industry in the next 10 years”

– Peter Diamandis

Disruption is coming

Thanks to technologies like EVA, the Bank of the Future could be a place to deposit not just your money, but other valuables – for example your will, your medical records, your biometric data.

The future for banks would seem to be bright… But the reality is that only a few of them are investing in this type of technology.

Those who do, moreover, are only investing 1-2% of their revenues into research and development (technology firms invest 10-20%).

With banks’ return on equity under 5%, it’s hard to see that changing significantly in the short to medium term, but if firms want to remain relevant, it has to.

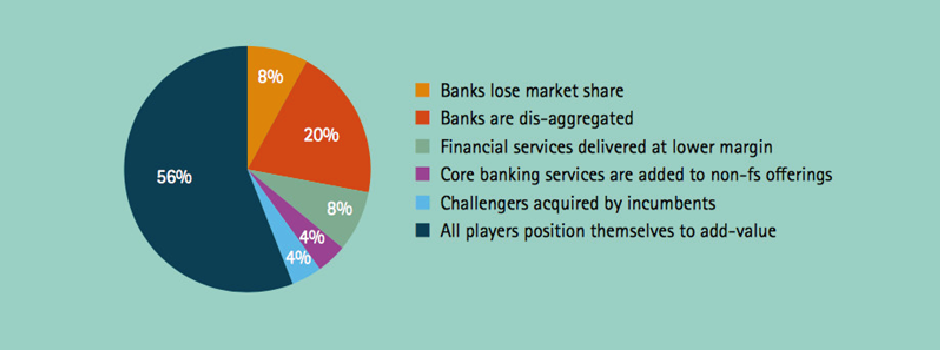

It is clear that the digital revolution is disrupting financial services, but the impact on current banking players is not as well defined.

Technology will change everything – becoming a potent enabler of increased service and reduced cost; innovation is imperative.

Branches or Technology?

Hypothetical banking future

According to reports, it is very likely that the biggest banks in the world in 2030 will be technology companies, and banks that grew through branch acquisitions in the ’80s and ’90s, that grew by physical bank presence, will have a real problem.

Many banks, instead of investing in new technology or acquiring FinTech startups, continue to make the mistake of spending significant sums on branches that look more like Apple stores thinking the consumers will return.

High-cost branches cannot survive in their traditional form.

Reality tells us instead that technology enables every aspect of banking to go online, and as cash

usage falls away, traditional branches are no longer necessary. Given their high-fixed cost, branches will need to become dramatically more productive, or significantly less costly.

The Future State

The role of today’s banks in such a future remains to be seen.

In a worst case scenario, they could become relegated to the position of a white labelled product provider.

In the best case scenario, with their customer base and experience in securely handling data, banks are in ideal position to create holistic customer solutions that combine financial services with a range of digital offers. It could be the key to their future prosperity.

“People need banking, but they don’t necessarily need banks”

– Heather Cox

Notes

Millennial Disruption Index,

http://ritholtz.com/2015/04/millennial-disruption-index

Half of the world’s banks set to fall by the digital wayside – BBVA,

https://www.finextra.com/news/fullstory.aspx?newsitemid=26965

KPMG introduces EVA – the bank of the future,

Meet EVA,

https://home.kpmg.com/content/dam/kpmg/uk/pdf/2016/10/meet-eva.pdf

The Future of Fintech and Banking: Digitally disrupted or reimagined?,

Breaking Banks – Brett King

The FinTech Book – Susanne Chisti, Janos Barberis

Retail Banking 2020 – Evolution or Revolution?