Strategy Outline

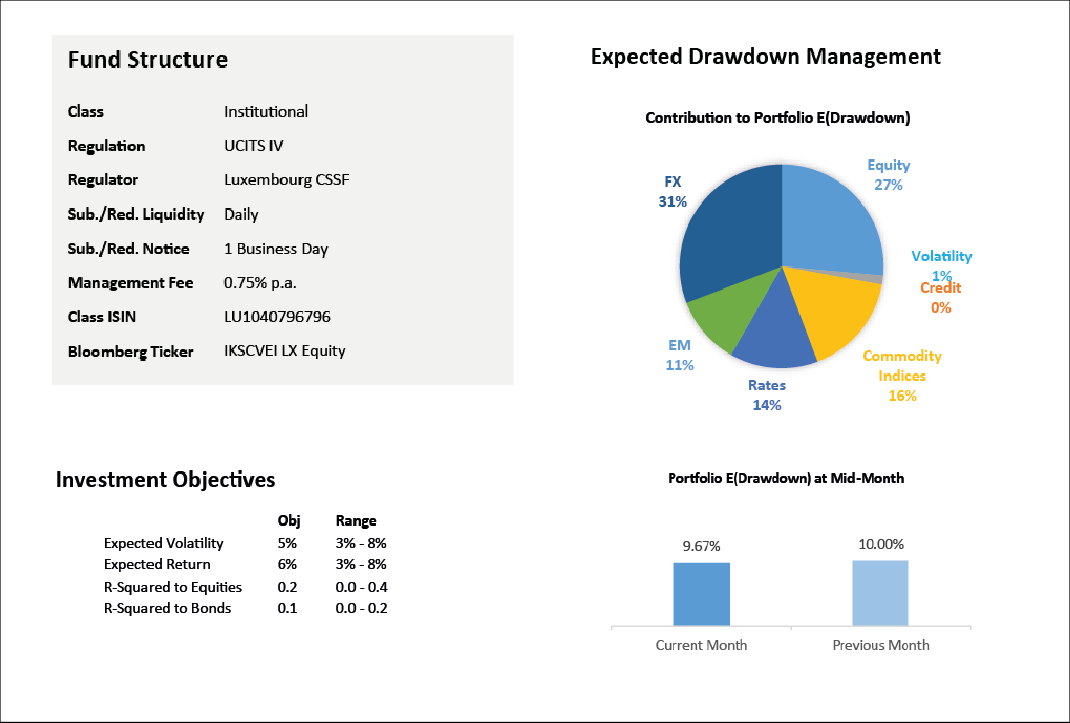

Liquid Premium applies the Expected Drawdown Management approach to liquid, multi-asset, alternative investing. The approach actively positions a diversified portfolio into the set of liquid investment strategies with the most attractive, forward-looking, drawdown-adjusted return potential at each moment in time. These strategies are directly implemented by the investment team using simple and liquid underlying securities such as futures, listed options, FX forwards, index swaps, ETFs, well-traded stocks and bonds.

The strategies include dynamically traded alternative strategies such as momentum, carry, value and behavioural strategies. Alternative strategies tend to perform distinctly from and, more importantly, tend to drawdown at different times to traditional equities and bonds investments.

January 2017

We expected January market movements to reverse the imbalanced trading activity that happened during the low liquidity Christmas and New Year season, and that is what has broadly happened. From this point on, our views we expressed on the new structural reflationary market are expected to continue into the year. We are positioned well to benefit if that continues, with a combination of commodities, short bonds, select equities and currency based exposures.

A material section of our expected drawdown contribution are what we call reversion-to-equilibrium trades. Examples of this include value trades, spread trades and mean reversion systematic trades amongst others. It happens that reversion-to-equilibrium do not provide consistent monthly returns like bond yields do, but they do provide the highest premium ratios today, which for our strategy are the most valuable investments.

The greater the imbalances that build into the system, the higher the premium ratios for these trades. Imbalances build because of business-asusual mentality despite deeper structural shifts in the underlying market, such as the shift from disinflationary to reflationary that happened recently. Given crytalisation events (such as rate rises, election results etc.) these imbalances can snap, and produce outsized returns significantly greater than their costs before the event. During these same events, assuming the outcome conforms with the equilibrium states, benchmark equities and/or bonds typically do not perform well.

For the short term, perhaps for the next month or two, we believe the relief of reflation will continue to provide a stable market. However, the election events across a number of key European countries in the following quarters provide good material for crystalisation events.